If 2020 spells CHAOS, what does 2021 spell?

This article was originally published on eBooleant.com. Join the over 900 investment professionals who viewed Dr. Fischer's post on this topic in his feed on Linkedin.

In the middle of a global disaster, prospects are good that we have the therapeutics to move back to a more neutral set of challenges relatively soon. But soon, however, will require at least the whole year for developed countries and much longer elsewhere. Looking ahead, only now we have a much better sense of the costs. We are, in a sense, paying for last year’s systemic risk.

What’s a systemic risk anyway?

Many of the long term trends we expected for the 21st century were suddenly and disastrously visited upon us in 2020. The worst costs of war and pestilence had been avoided long enough that we no longer priced them properly. The Pax Americana has kept the cost of war to manageable levels for going on a century now. To be assured, it has been a relative peace, but peaceful enough to allow surging global prosperity.

We have also had good outcomes in the biomedical experience, overcoming polio and keeping a number of viral attacks contained. Now, the number of viral attacks appears to be increasing in part because human habitation is reaching deeper into the equatorial jungle breeding ground of viruses. When we tour caves with millions of bats, we are at ground zero for viral evolution. But the use of vaccines has proved to be effective in containing them.

And we should now include technology as a systemic risk. Of course, the seminal event for this was the now long forgotten Y2K experience. In the early era of computing we cut corners to save expensive memory space and it all came home to roost at “00.” Dates were cut to two digit years and the computer code didn’t know what century we were talking about. It seems quaint now, but it almost brought the country to a halt. It could have been a model for the disaster that we face now except that it was avoided. The Y2K experience was no hoax and the political apparatus understood the peril and spent the billions to prevent it.

Not all systemic risks are equal

War, famine, and pestilence as well as big banks? Clearly not all systemic risks are equal. None of these risks are good, of course, but we should be clear about why we were surprised by COVID-19 having had so many successes with systemic threats.

One answer is that we need a taxonomy of systemic risks. Y2K, for example, is not a good model for our COVID risk. Y2K was a computer “virus,” which is not a virus at all. COVID is a Virus.

COVID is alive.

Biologists are fussy about defining what is alive. COVID can’t self-replicate but by human standards it is a living adversary. We face a virus which has a strategy for survival. And a very good one. It will mutate to try to outrun our defenses. Assume that we will win but at a high cost.

Controlling the costs

Homo sapiens have endured many epidemics in the past but at vastly different costs. As a policy matter, employing our cultural tools to minimize the cost of COVID is the challenge. Here is what to expect in a few key areas.

Monetary policy

Monetary policy will remain at crisis easing levels for at least the next year. The Fed has no intention of creating another financial crisis by even intimating the return to anything like a long term equilibrium. The Fed intends to keep short rates near zero and bond buying as high as necessary for economic growth. The Phillips Curve is dead. This low interest rate environment will be consistent with below 2% inflation no matter what unemployment does. And unemployment will remain high.

This suggests continuing staggering Treasury and corporate bond issuance. Munis will also see few defaults and record issuance driven by refundings. The states have, with good reason, virtually given up on federal infrastructure packages.

Asset purchases will have an upward bias as economic growth returns. Gyrations of growth and contraction in the economy are to be expected but within a range to 2% to -2% for annual GDP.

The Fed will pull out all the stops to keep the economy growing. This strongly suggests that negative rates are on their way. [1]

Fiscal policy

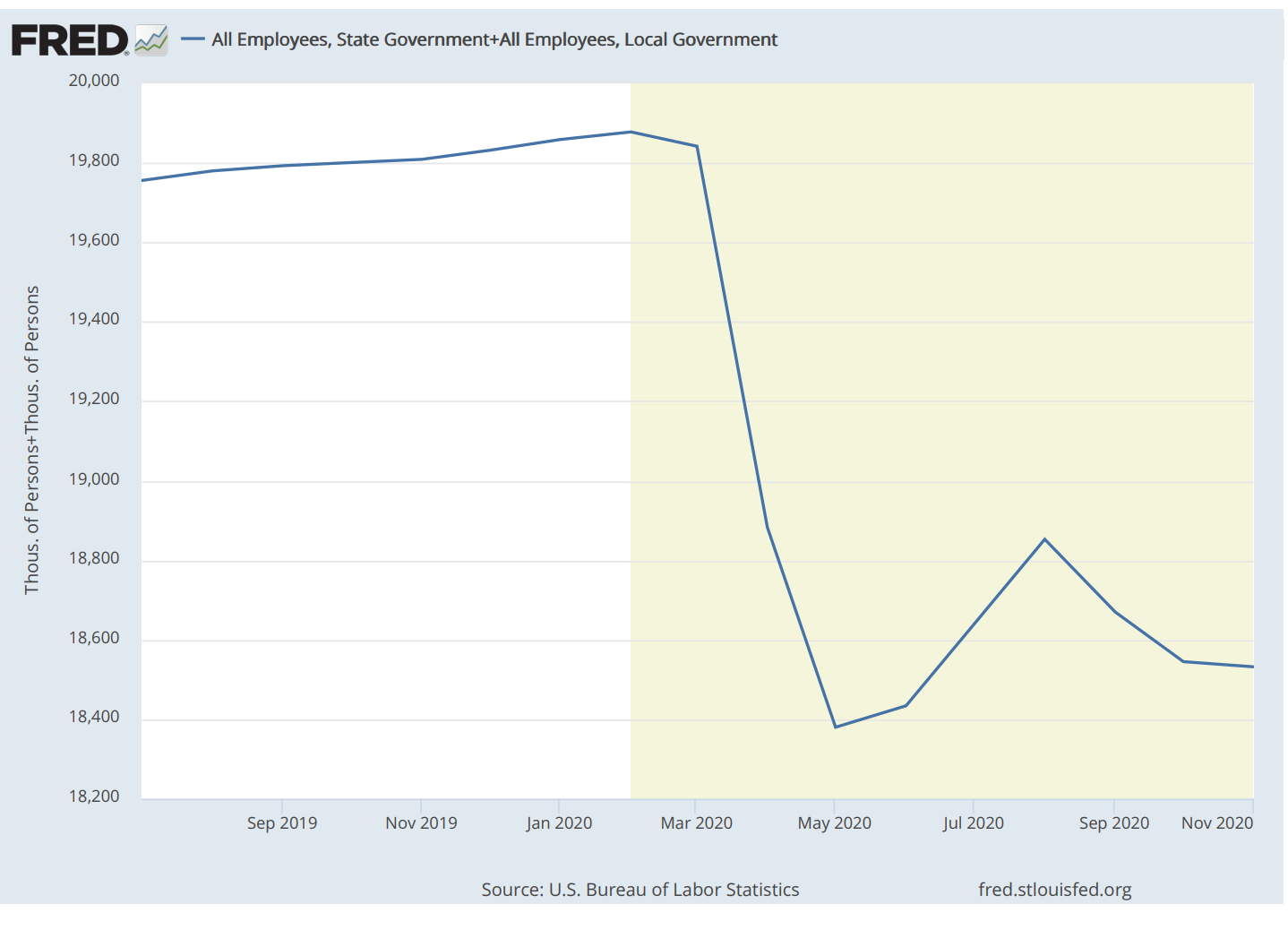

Fiscal will also be at full steam. The details of the election are still playing themselves out. Nevertheless, a steady stream of economic stimuli along with a skyrocketing debt would not be a surprise. The level of state and local employment shown in Chart 1 is a good barometer of the social tensions driving increasing Federal budgets. State and local employment has fallen dramatically, and as we saw in the Great Recession, may be slow to recover.

Wealth concentration and budget deficits will fuel tax changes. Tax increases at the Federal and state levels are a given. The Trump tax cuts will almost certainly be eliminated this year. Increases in other taxes are a virtual certainty, too. State tax increases will continue to drive the panic flight of the wealthy from high income states. Tax shelters will achieve scarcity value especially muni bonds.

Chart 1

What to Expect

The Big World Order of the 1900s has returned along with its pandemics. This Pandemic will pass as a national preoccupation when inoculations press forward and the production of vaccine increases. By fall the MMT view of a world full of free money will be challenged, especially by military necessities. As global domination is fought on the tech level with Russia and China, technology expansion will surge into space exploration and new dimensions of biotech.

The main problem we face isn’t just winning the Pandemic and the peace this year, the long term cost is important, too. We are in a bio war and threatening international conflicts. These are expensive and enervating. What does 2021 spell? Prepare.

We hope you enjoyed this article. Please give us your feedback.

[1] “SIFMA Issues Checklist in the Event US Interest Rates Turn Negative,” SIFMA Issues Checklist in the Event US Interest Rates Turn Negative (SIFMA, December 21, 2020).