The Federal Reserve - the long view comes into view

Dystopian worlds are a favorite subject in science fiction and a nightmare for central banks. As the Federal Reserve heads into a seminal period of interest rate decisions, it must see itself in that kind of dystopian world. Europe is at war, which looks likely to expand. Inflation looks headed for double digits and the economy is contracting. Stagflation is on the deck just as Covid mutates to a seasonal flu.

Add to this, the entire world order is in flux without a clear cannon of beliefs. A new cold war is emerging as China and Russia align economically and militarily. In all of this, the Federal Reserve tries to be a bastion of conservative moderation. But it oversees a superstructure of banks which are being increasingly irrelevant to the public as fintech eat at their margins.

The number of FDIC insured banks in the US declined 49% between 2000 and 2021, which is hardly an endorsement of current Fed procedures. And now the Fed is using its remaining moral authority to initiate a cycle of increasing rates. The Fed is setting up to slow an already slowing economy and to reduce the inflation Congress has set off. This is sure to be a dystopian cycle leading into the midterm elections. And it is only the beginning as the Fed needs to develop its own digital currency.

Politics

In figuring out the immediate future for the Fed we can count the days to the Midterm elections. As of May, there will be four regular meetings before November this year. June 14-15 (Tuesday-Wednesday) July 26-27 (Tuesday-Wednesday) September 20-21 (Tuesday-Wednesday) November 1-2 (Tuesday-Wednesday).

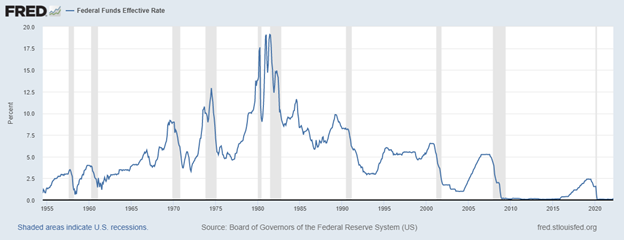

The history of the Fed Funds rate shows that the Fed can raise short term rates rapidly, but not without inducing a recession. In recent years Fed Funds rates above 5% have produced a recession. Fed Chairman Powell seems very conscious of this. Powell has indicated that a 50bp bump is likely at the next meeting. A 5.0% rate is a barrier. But it is not the only one. There is another constraint on Fed Funds – the election.

The Fed has evolved its mandate over time and now it is best seen as a political institution in a sea of Washington D.C. political institutions. As such, the Fed’s management cycle is constrained by the need to be neutral going into the midterms. Or at least, not fighting the dominate Congressional and White House powers. The Fed raising rates is a political problem and one of the Fed’s own creations.

Fed needs to restructure

The midterms illustrate the structural problems of the Fed. At the same time, digital currencies are challenging the Fed, which is exploring its alternatives with the Central Bank Digital Currency (CBDC). It is hardly alone and quite late to the party. As one hundred countries around the world begin a transition to a version of a digital currency. But the move to CBDC offers a rare chance for the Fed to fundamentally reexamine its monetary policy management.

What can we expect?

The Fed is going to bluff about rate increases. It will increase rates in the next meeting but do little after that as the economy contracts. Inflation will stay high. The ball will pass to the Congress and administration to try to manage inflation. The banking system will see the number of FDIC-insured banks continue to contract, especially as cryptocurrency firms and fintech moves into the space.

The Fed will reluctantly begin an experiment with CBDC and with that experiment will come the beginnings of an involuntary restructuring. Two features of CBDC offer the Fed fundamental opportunities to restructure. First, CBDC offers continuous monetary policy rather than the discrete forms in use now. The Fed can shift away from the discrete steps in Fed Funds rates. This is especially true if it adopts an interest-bearing CBDC.

Secondarily, and the most important, the emergence of a CBDC is giving the Fed a first step from restructuring away from an autocratic centralized authority to one that will be less costly to the member banks. More new banks will want to join the system. It will also give the Fed the new tools to manage in this uncertain and convulsive time.

Investor Implications:

1. The Federal Reserve is highly constrained and not likely to be able to reduce inflation quickly.

2. Investors should expect that the Fed will continue to lose participating banks until it reduces costs and restructures to a more digital system.

We hope you enjoyed this article. Please give us your feedback.

This article is not intended as investment, tax, or financial advice. Contact a licensed professional for advice concerning any specific situation.