They’re gonna write a book about this

This article was originally published on eBooleant.com. Join the over 2,000 investment professionals who viewed Dr. Fischer's post on this topic in his feed on Linkedin.

Looking past the pandemic is now an established industry. And given the political environment, it offers something of a safe harbor in a turbulent time. Unlike elections, pandemics do end but what comes after is a matter of great conjecture.

The immediate source of insight for post pandemics is of course The Great Gatsby, which documented a period including the end of the Spanish Flu pandemic and ushered in what we call the Roaring Twenties. In the book, Fitzgerald left us many lessons which I interpret to be ‘bootleggers can be cool’ and ‘drive carefully,’ but oddly none about how to deal with a pandemic. Nor is he alone. The sheer awfulness of the War to End All Wars and the Spanish Flu generated a collective amnesia about the times, even for the participants. Are we headed to the Roaring Twenties? Maybe. We will get enough of a bump in GDP to call it the Roaring Fed.

What will we get?

It’s as boring as it is dismal: Death and Taxes. So let’s start with death. Total COVID-19 deaths are now 433K headed toward an estimated 600K later this year.[1] This does not include a significant number of other deaths by despair accelerated by COVID-19.[2]

Of course, this level of morbidity has important GDP implications over the long term. The overall life expectancy at birth for the population has declined by over a year, the largest drop in more than 40 years.[3] This implies a substantial drop in economic activity by itself, without lockdowns or any of the other associated economic depressants we have experienced.

Still, the IMF is projecting a global economic growth of 5.5% for 2021 and 4.2% for 2022 after the worst pandemic in a century.[4] So has the IMF read The Great Gatsby and decided to forget the pandemic and get on with the Roaring Twenties? To tell the truth, the various Quantitative Easing and other Fed stimulus programs were an effort to get to the Roaring Fed but never made it. For those with a long history in finance, it is solidly unnerving to hear the Treasury Secretary Janet Yellen instruct the Congress to “act big” as she did a few days ago, but the intent of the Administration is clear.

There are a few niggly problems (headwinds) associated with the administration program. The political environment domestically will remain toxic if not violent. Nature seems bent of a lot of destruction and our foreign adversaries will make life as miserable as possible. But inflation seems at bay and the information explosion is well founded. If that is not enough, formally or not, the US is now a willing Modern Monetary Theory (MMT) advocate at enough policy levels that the planned deficits do not matter, for now.

Just how high will taxes go?

This gilded age is headed for a fiscal trim at the federal and state level. The almost immediate repeal of the Trump tax cuts can be expected in the short run. Salt should be back and capital gains will be in for special attention. That’s this year. Perhaps the Supreme Court will surprise us, but at this point there seem few practical limits on the taxing power of the Congress. A one hundred percent tax bracket would have a nice ring to it in some circles.

At the state level, normally a booming economy will induce lower taxes. At least that’s what happened in the last Roaring Twenties when top federal income tax rate fell from 77 to 25 percent. The higher taxing Northeastern states seem to be resisting the call to higher taxes but those in the West are not. Competition between high and low tax states can be expected to intensify with wealth and technology flowing to lower tax regions.

A whole bunch of roaring

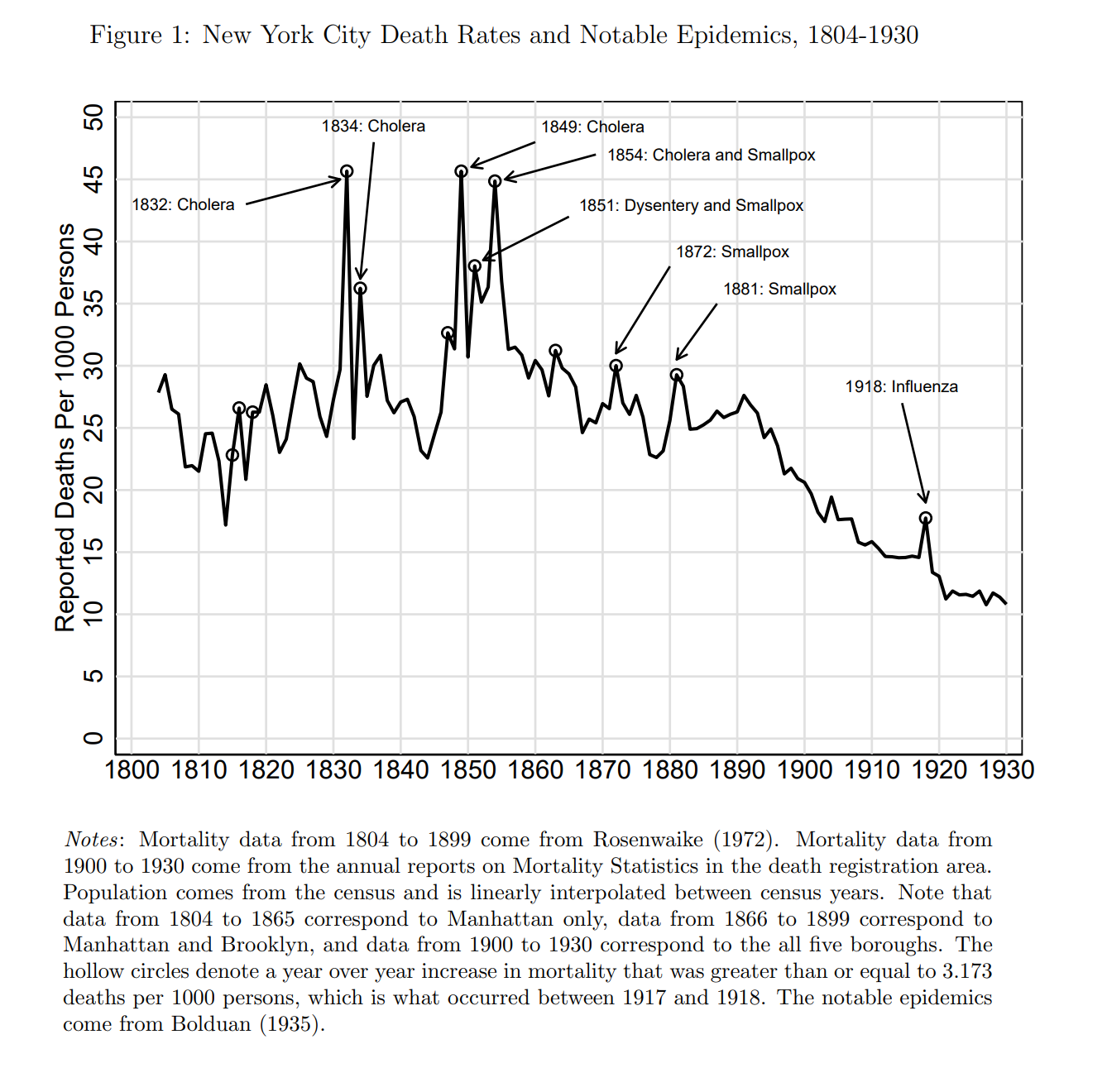

The Biden administration is likely to inherit an economy coming out of a pandemic and claim victory. And we dearly await a new Fitzgerald, since so much material awaits. Still, it takes only a short glace at history to understand the silence of the Lost Generation. Figure 1 below shows what they knew going into the Roaring Twenties. Pandemics can be so severe and common that they were hardly worth talking about. Even a big one.

[1] Covid Data Tracker, United States COVID-19 Cases and Deaths by State accessed January 29, 2021.

[2] Quentin Fottrell, “Deaths of despair' during COVID-19 have risen significantly in 2020, new research says,” Dow Jones Newswires (article run on Morningstar Marketwatch), accessed January 29, 2021.

[3] University of Southern California. "COVID-19 reduced U.S. life expectancy, especially among Black and Latino populations: Life expectancy at birth will shorten by more than one year." ScienceDaily. (accessed January 29, 2021).

[4] International Monetary Fund. Policy Support and Vaccines Expected to Lift Activity. World Economic Outlook Update. January 2021.

We hope you enjoyed this article. Please give us your feedback.